Hostplus’ 'Notice of intent to claim a tax deduction’ (NOITC) form is now available digitally through

Member Online.

Our products and services

Hostplus Outstanding Value Super

8 years in a row

We’re proud to have won Canstar’s Outstanding Value Super Award for the eighth year in a row. The award recognises our strong long-term performance, competitive fees and an array of product features.

Learning Hub

Try SuperSmart today

An interactive way to get financial education and tailored advice* online to help supercharge your future.

Exclusive to Hostplus members 24/7 via Member Online at no extra cost.

*Members with Term Allocated Pension, Lifetime Pension, Defined Benefit Pension, nil balances, non-standard investment options and some Maritime Contributory Accumulation members cannot access SuperSmart financial advice services.

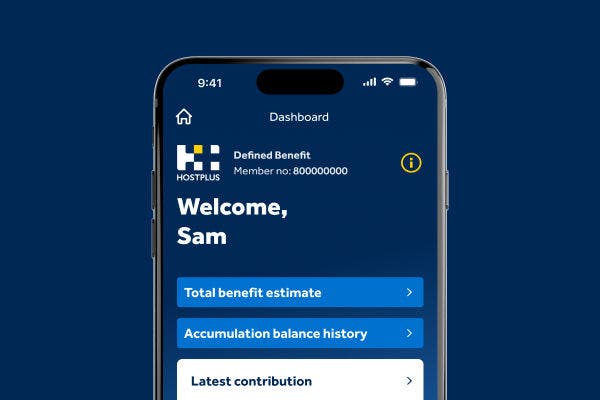

Manage your super

It’s easy on the Hostplus app

Defined benefit members are now welcome to download our mobile app and try out a range of helpful features. View total benefit estimates, monitor investments, check insurance and more.

Retirement

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Forms and resources

Our notice of intent to claim a tax deduction (NOITC) service is available online

Simply log in to Member Online, navigate to ‘Super’ in the top menu, and select

‘Claim a tax deduction’.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why choose Hostplus

Reminder: EOFY super contributions

If you want your employees' Super Guarantee payments to be processed before the end of the financial year, Hostplus must have received and receipted the contribution by 30 June. For the best chance of meeting this deadline, we recommend submitting payments earlier than usual, in case there are any issues processing your payment.

Processing times will vary across clearing house services, so check with your provider for cutoff dates. You can find out more about how to make super payments on our website.

Your responsibilities

Reminder: EOFY super contributions

If you want your employees' Super Guarantee payments to be processed before the end of the financial year, Hostplus must have received and receipted the contribution by 30 June. For the best chance of meeting this deadline, we recommend submitting payments earlier than usual, in case there are any issues processing your payment.

Processing times will vary across clearing house services, so check with your provider for cutoff dates. You can find out more about how to make super payments on our website.

How to make payments

Reminder: EOFY super contributions

If you want your employees' Super Guarantee payments to be processed before the end of the financial year, Hostplus must have received and receipted the contribution by 30 June. For the best chance of meeting this deadline, we recommend submitting payments earlier than usual, in case there are any issues processing your payment.

Processing times will vary across clearing house services, so check with your provider for cutoff dates. You can find out more about how to make super payments on our website.

Tools and resources

Reminder: EOFY super contributions

If you want your employees' Super Guarantee payments to be processed before the end of the financial year, Hostplus must have received and receipted the contribution by 30 June. For the best chance of meeting this deadline, we recommend submitting payments earlier than usual, in case there are any issues processing your payment.

Processing times will vary across clearing house services, so check with your provider for cutoff dates. You can find out more about how to make super payments on our website.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why Hostplus

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Product and fee information for advisers

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

News and insights

Investment options

Pricing and performance

Tools and resources

News & insights

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Our company

Careers

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Short form summary of expenditure

Some payments have been counted in more than one category, as required by s29P(3) of the Superannuation Industry (Supervision) Act 1993 (Cth) and reg 2.10 of the Superannuation Industry (Supervision) Regulations 1994 (Cth) (SIS Regulations).

Table 1.

| Expenditure for the financial year 2022/23* | |

|---|---|

| Aggregate remuneration expenditure | $ 7,960,394 |

| Aggregate promotion, marketing or sponsorship expenditure | $ 30,024,081 |

Aggregate political donations | $NIL |

| Aggregate industrial body payments | $ 1,941,019 |

Aggregate related party payments | $ 19,288,708 |

*Amounts presented are inclusive of GST and on a cash basis.

Remuneration

Hostplus sets remuneration at a level designed to attract and retain skilled and capable staff.

These payments include the remuneration for Hostplus’ chief executive and all group executives as well as fees paid to directors, alternate directors and other board committee members.

Remuneration details are available at hostplus.com.au/remuneration-policy

Breakdown of expenditure

Hostplus will publish an itemised list of expenditure in the following categories, from mid-November 2023:

- promotion, marketing or sponsorship expenditure

- political donations

- industrial body payments

- related party payments.