Our products and services

Hostplus Outstanding Value Super

8 years in a row

We’re proud to have won Canstar’s Outstanding Value Super Award for the eighth year in a row. The award recognises our strong long-term performance, competitive fees and an array of product features.

Learning Hub

Try SuperSmart today

An interactive way to get financial education and tailored advice* online to help supercharge your future.

Exclusive to Hostplus members 24/7 via Member Online at no extra cost.

*Members with Term Allocated Pension, Lifetime Pension, Defined Benefit Pension, nil balances, non-standard investment options and some Maritime Contributory Accumulation members cannot access SuperSmart financial advice services.

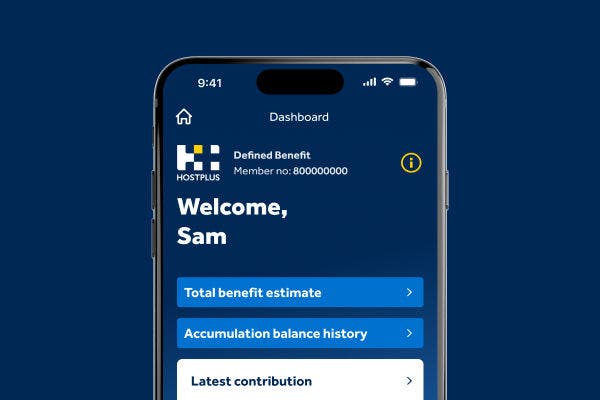

Manage your super

It’s easy on the Hostplus app

Defined benefit members are now welcome to download our mobile app and try out a range of helpful features. View total benefit estimates, monitor investments, check insurance and more.

Retirement

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Forms and resources

Our notice of intent to claim a tax deduction (NOITC) service is available online

Simply log in to Member Online, navigate to ‘Super’ in the top menu, and select

‘Claim a tax deduction’.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why choose Hostplus

Reminder: EOFY super contributions

If you want your employees' Super Guarantee payments to be processed before the end of the financial year, Hostplus must have received and receipted the contribution by 30 June. For the best chance of meeting this deadline, we recommend submitting payments earlier than usual, in case there are any issues processing your payment.

Processing times will vary across clearing house services, so check with your provider for cutoff dates. You can find out more about how to make super payments on our website.

Your responsibilities

Reminder: EOFY super contributions

If you want your employees' Super Guarantee payments to be processed before the end of the financial year, Hostplus must have received and receipted the contribution by 30 June. For the best chance of meeting this deadline, we recommend submitting payments earlier than usual, in case there are any issues processing your payment.

Processing times will vary across clearing house services, so check with your provider for cutoff dates. You can find out more about how to make super payments on our website.

How to make payments

Reminder: EOFY super contributions

If you want your employees' Super Guarantee payments to be processed before the end of the financial year, Hostplus must have received and receipted the contribution by 30 June. For the best chance of meeting this deadline, we recommend submitting payments earlier than usual, in case there are any issues processing your payment.

Processing times will vary across clearing house services, so check with your provider for cutoff dates. You can find out more about how to make super payments on our website.

Tools and resources

Reminder: EOFY super contributions

If you want your employees' Super Guarantee payments to be processed before the end of the financial year, Hostplus must have received and receipted the contribution by 30 June. For the best chance of meeting this deadline, we recommend submitting payments earlier than usual, in case there are any issues processing your payment.

Processing times will vary across clearing house services, so check with your provider for cutoff dates. You can find out more about how to make super payments on our website.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why Hostplus

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Product and fee information for advisers

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

News and insights

Investment options

Pricing and performance

Tools and resources

News & insights

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Our company

Careers

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

- Home

- Members

- Our products and services

- Super

- Why choose Hostplus?

Why choose

Hostplus?

From our low admin fee1 and strong long-term returns2 to our wide range of investment choices – including a socially responsible option – we’re striving to provide you with the future you deserve.

That’s a plus. (In fact, it’s a whole lot of them.)

Your goals

are our goals

Let’s reach them together.

Consistently strong returns

We measure our success by what we deliver for our members, and we’re proud of our award-winning performance.3 Our default Balanced (MySuper) option is just one example – it’s ranked the number one option over rolling 10 and 20-year periods.2 But don’t just take our word for it. We’re proud to have received awards for having some of the best super products on the market.

A low admin fee

We have one of the lowest admin fees out of any MySuper product.4 Why? A low admin fee may mean more super for you.1 That's a plus.

A long-term investor

We invest your money into projects and assets that aim to derive strong investment returns for our members. Plus, our socially responsible investment (SRI) options allow you to choose investments that align

with your personal values.

plus many

more benefits

An industry super fund

We put our members first. As an industry super fund, our profits go back to our members – not shareholders. Maximising your investments is our focus.

A fund for all Australians

We’ve been helping our members save for retirement for more than 30 years. In fact, 1.8 million Australians across a range of industries choose Hostplus as their lifetime super fund.

24/7 access

We give you more control over your super. Our Member Online portal and Hostplus app allow you to check your balance, update your details and get real-time notifications of contribution payments – 24/7.

Investment choices

As you move through life, your circumstances change. Our investment options are designed so you can choose an option that best suits your needs and objectives, including your risk appetite.

Insurance options

The right level of insurance can help give you peace of mind. It’s why we offer a range of different insurance options to suit your current stage in life.

Advice and financial planning

Whether its general advice or comprehensive financial planning, our superannuation advisers and financial planners are available to help you set and meet your retirement goals.

Review us against our competitors and see how we compare.

Award-winning superannuation

Ready to join? It’s easy - online applications only take five minutes.

Or call us on 1300 467 875

8am – 8pm (AEST/AEDT), Monday to Friday.

Build the future you

deserve with Hostplus

Compare superannuation funds

We’re proud that Australians from all walks of life choose us as their preferred super fund. Whether it’s for our competitive fees or our multi-award-winning performance. Review us against our competitors to check how we compare with other funds.

Our fees and costs

Every dollar you save goes a long way to helping you achieve a future full of positivity. It’s why we strive to keep our fees and costs as low as possible.

Learn about super

Super is a long-term commitment. Learning how to get the most out of your super is important, which is why we give you the tools you need. Discover your investment risk appetite, choose the right investment option and learn more about super.

1. Other fees and costs apply. Refer to the PDS for more information, available at hostplus.com.au/pds.

2. Hostplus Balanced (MySuper) investment option compared to the SuperRatings Accumulation Fund Crediting Rate Survey – SR50 Balanced (60–76) Index at 31 March 2025. Past performance is not a reliable indicator of future performance.

3. Awards and ratings are only one factor to be consider when choosing a super fund. Visit hostplus.com.au/awards for awards criteria and disclaimers.

4. Other fees and costs apply. Refer to the PDS for more information, available at hostplus.com.au/pds. Hostplus Balanced (MySuper) investment option compared to SuperRatings fee data for public offer MySuper products extracted from SMART platform on 23 April 2025. Comparison is based on the total administration fees and costs assuming a $50k account balance.